Small business workers’ COMPENSATION

What does workers’ comp cover?

Workers’ comp pays for lost wages, medical expenses, and legal protection when people get hurt.

It covers common injuries like…

- Slips, trips, and falls

- Falling objects/walking into something

- Motor vehicle accidents

- Repetitive motion injuries

- Cuts and lacerations

…AND uncommon injuries like…

- Bruises from team building events gone awry

- Company-wide food poisoning from bad catering

- Third-degree burns from the office coffee pot

- Encounters with angry, rabid wildlife on site

Workers’ comp keeps everyone out of financial trouble in the event of an “oopsie”.

Let’s say … Ellie owns a restaurant.

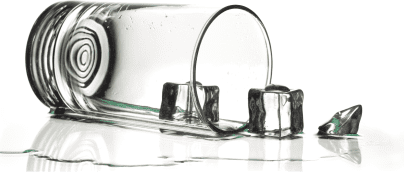

Someone spills water on the floor. (Hey, we’re all human.)

Ellie asks her employee Ray, to clean it up.

Ray slips and sprains his knee. Uh-oh.

Luckily, Ellie’s workers’ comp policy has both her and Ray covered. Phew.

Why choose Cerity for workers’ comp?

Wicked fast claims processing

It only takes a few minutes, whether you’re already covered or just getting started.

Registered nurses on call 24/7

Need more info?

It really is this simple, but here’s some more in-depth reading if you like.

FAQs

How can I reduce my claims risk?

To reduce your claims risk, you could start with implementing a safety program and accident prevention training. For more help and information, please visit our handling claims section of the website here.

I've been told my Workers' Comp policy is an auditable policy. What does that mean?

Workers' comp policy price is largely based on your payroll over your policy period. We understand that over the course of your policy period, changes occur...life happens! After your policy period ends, a payroll audit will be conducted by Cerity to verify actual payroll & classifications to determine the final premium.

What do I need to do to implement a safety program in my workplace?

Put simply, establishing and maintaining a safety program with your team may reduce losses, which reduces your workers' compensation premium over time. To get started:

- Assess your workplace, and identify known hazards and risks

- Develop written programs and a process for when accidents occur

- Provide safety training to your employees, educating them on what to do if an accident occurs

- Clearly post safety protocol for handling equipment and hazardous materials

- Create a safety committee, focused on continuous monitoring and improvement of the program

Here are some examples of safety work programs provided by the US Department of Labor, which can reduce your premium over time.

How is Workers' Compensation related to payroll? What do I do when I hire, give raises or fire employees?

The estimated premium is based on estimated payroll (at the beginning of the policy). The final premium is based on actual payroll (at the end of the policy) for the policy period (usually 12 months). In the event your payroll changes, we'll work with you on adjusting your policy.

How much does Workers’ Comp Insurance cost?

The cost, or premium, varies depending on the jurisdiction your business is in as well as the nature of your business or operation. At Cerity, in order to determine an affordable price for your business, we evaluate your company's specific operational history and your business' payroll.

I subcontract work to other companies/firms. Do I need to check if they are complying with Workers' Comp laws?

Yes, if you subcontract some of your work to other businesses or individuals, you should always ask them to provide a Certificate of Insurance to ensure they are covered. However, a Certificate of Insurance (COI) isn't a guarantee of coverage (policy may have cancelled since issuance). You should request periodic COIs throughout the contract.

What does Workers’ Comp Insurance cover?

Workers' compensation insurance provides all state required benefits, including reasonable and necessary medical treatment and wage replacement, for employees injured in the course and scope of employment.

What happens if I don't have Workers' Comp Insurance?

If you, as a business owner, do not obtain workers' compensation insurance for your business, you may expose your business to a multitude of risks including potential lawsuits from injured employees, penalties for failing to obtain statutory coverage per state law, permanent closure of your business, and a variety of fines.

Why do I need Workers’ Comp Insurance?

In most states, it’s required for small business owners to obtain workers’ compensation coverage. In the event that an employee is injured in the course and scope of your employment, workers' compensation insurance protects you from costly lawsuits and provides state required compensation for the employee, including lost wages and medical expenses.

What is Workers’ Comp Insurance?

Workers’ compensation is a form of business insurance which provides state required benefits to employees injured in the course and scope of employment, including wage replacement and medical benefits. It also protects your business from liabilities resulting from injuries arising in the workplace.